On January 7, 2025, areas in and around Los Angeles County were affected by a series of catastrophic wildfires fueled by straight-line winds. In response, the White House issued a Major Disaster Declaration on January 8, 2025. Following this, on January 10, 2025, the Internal Revenue Service (IRS) ...

SALT

Tax Year-End Checklist

President-Elect Donald Trump’s Tax Policy Proposals

On May 10, 2024, Governor Bill Lee enacted Public Chapter 950 which resulted in the removal of the property measure component from the franchise tax computation for tax years ending on or after January 1, 2024. Under this legislative amendment, taxpayers who previously remitted taxes based on the ...

From the enactment of the Tax Cuts and Jobs Act of 2017 (TCJA), California was one of the handful of states that did not conform to a number of provisions in the law. Most notably, the state continued to allow taxpayers to take full advantage of the net operating loss (NOL) deduction and ignore 80% ...

In July 2023, the Texas legislature passed Senate Bill 3, which increased the no tax due threshold and eliminated reporting requirements for certain entities. In response, the Texas Comptroller's office has issued guidance and changed the way some entities have to report for franchise tax purposes ...

Effective January 1, 2024, the Ohio Commercial Activity Tax (CAT) will undergo major changes following the enactment of Am. Sub. H.B. 33 of the 135th Ohio General Assembly.

Big news for franchise owners in Oklahoma: Oklahoma House Bill 1039 enacted on June 2, 2023, repealed the franchise tax and the reporting requirements starting with tax year 2023.

The Internal Revenue Service reminded individuals and businesses in most of California and parts of Alabama and Georgia that their 2022 federal income tax returns and tax payments are due on Monday, Oct. 16, 2023. The normal due date of April 18 was postponed for many residents of these states in ...

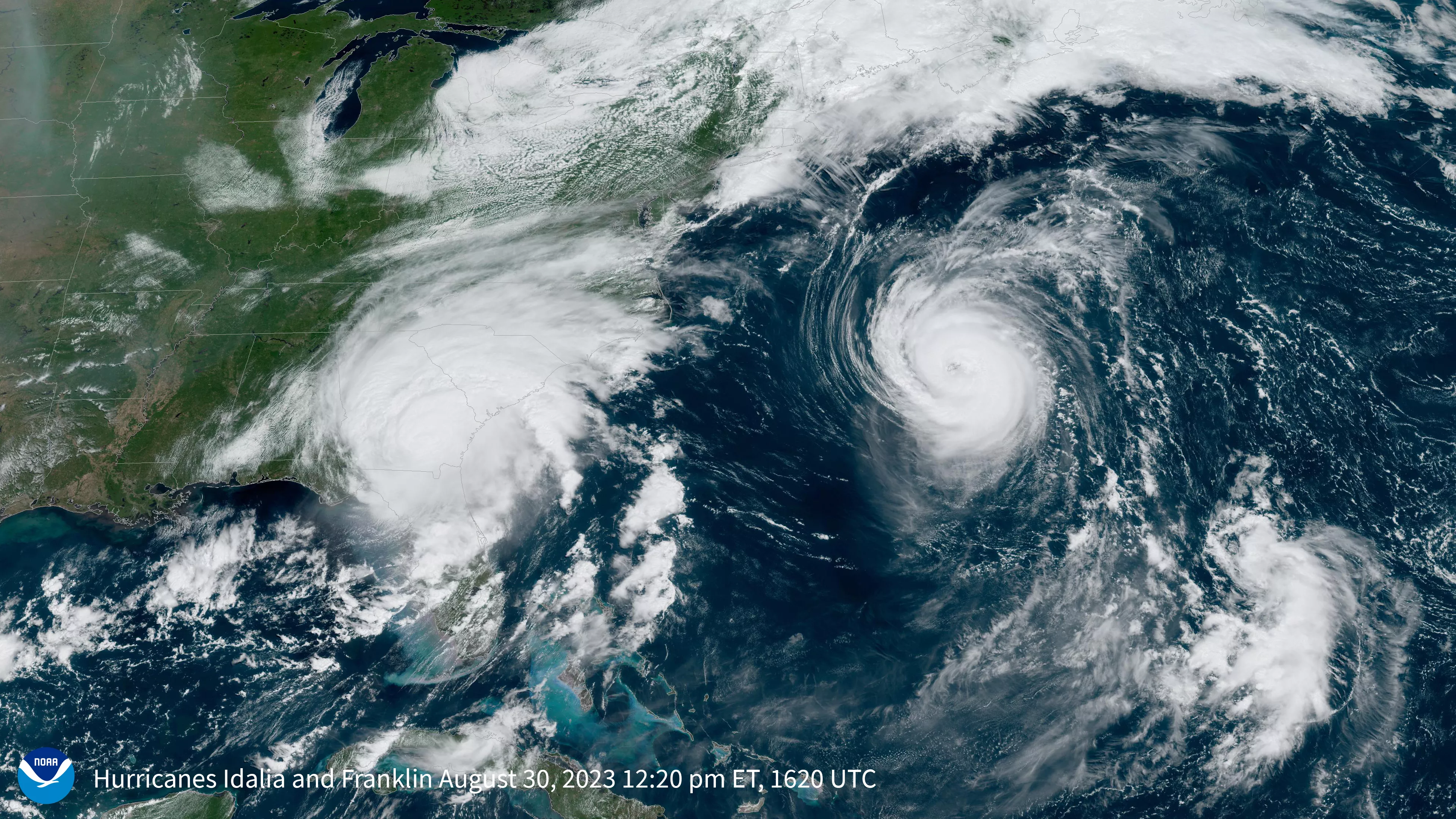

IRS: THOSE IMPACTED BY IDALIA QUALIFY FOR TAX RELIEF; OCT. 16 DEADLINE, OTHER DATES POSTPONED TO FEB. 15