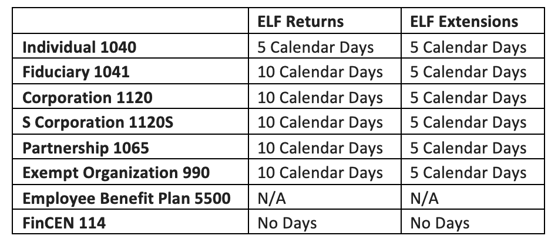

Federal & State Electronic Filing Perfection Periods

Have you ever wondered how many days you have to correct an e-file rejection and resubmit your tax return or extension to be considered timely? Per Publication 4163 Tax Preparers have the following grace periods to correct and retransmit returns or extensions that were timely filed but were rejected by the filing deadline. The IRS considers returns that are re-filed electronically during the applicable time frame as timely-filed returns.

Click here to download the above chart in an excel format for your own use.

Keep in mind that the perfection period starts at the time of the rejection and is never extended for weekends, holidays, or end-of-the-year cutoff.

Publication 4163 also recommends that “When a return is rejected on the due date, it is recommended that the EFW (Electronic Funds Withdrawal) payment not be transmitted with the return and that another payment option be used.”

Form 5500 has no limit for the grace period on rejected returns, but returns should be resubmitted as soon as possible. Technically, the return is filed and posted on the DOL website, even if the status is rejected.

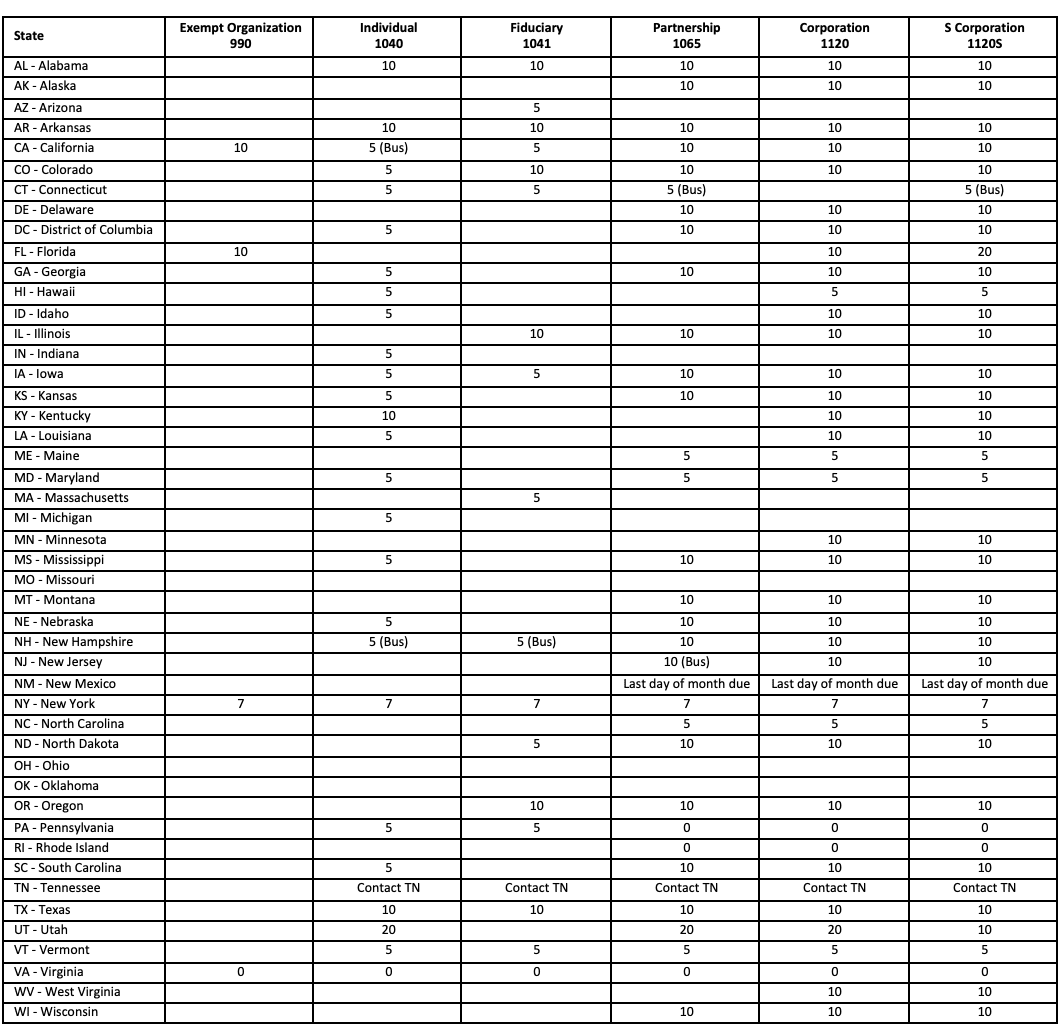

The deadline for resubmitting a rejected state tax return for electronic filing varies depending on the specific state’s requirements. If the return is rejected on deadline, you have the number of calendar/business days (provided below) from the due date of the return to e-file the corrected return. In addition, you should also check with your state’s tax agency to determine the deadline for resubmission.

Click here to download the above chart in an excel format for your own use.

Notes:

- In the event that paper filing is required after rejection, we advise to include a copy of the rejection detail and return history with the paper filed return.

- 0 indicates the return is due no later than the due date.

In general, most states will require you to resubmit your rejected state tax return as soon as possible. It is important to correct any errors or issues that caused the rejection and resubmit your return promptly to avoid any penalties or interest charges.

Article by Zaid Butt, Director