Is Paying Passthrough Entity Tax a Smart Move for My Business?

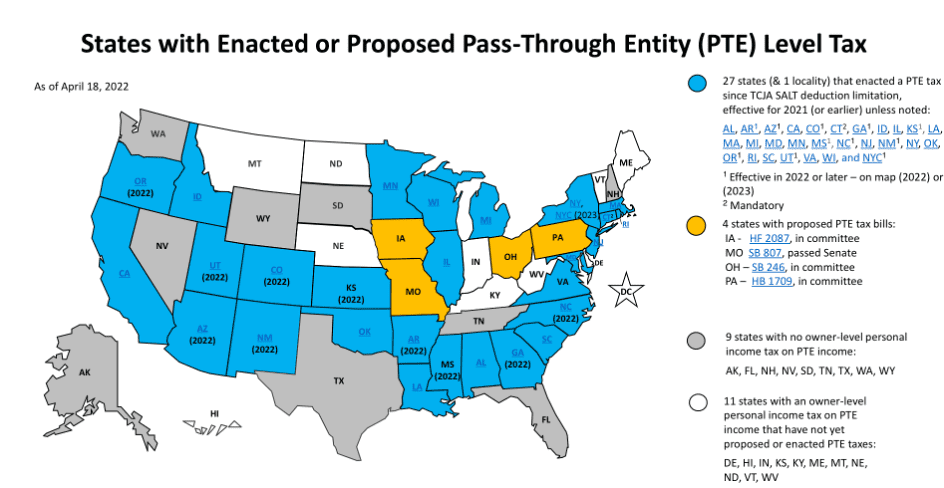

Much to the dismay of taxpayers in high-tax states, 2017’s Tax Cuts and Jobs Act created a $10,000 cap on an individual’s itemized state and local tax (SALT) deductions. In response to this limitation, 27 states, including California, New York, New Jersey, and Connecticut, have implemented workarounds that allow for state tax deductions at a passthrough entity (PTE) level. This workaround, which involves the payment of passthrough entity tax (PTET), has become increasingly popular with certain small and midsize businesses.

Source: American Institute of Certified Public Accountants

What are the benefits of paying passthrough entity tax?

In this scenario, a passthrough entity elects to pay taxes, and provides the owner with a credit or deduction for the tax paid by the passthrough entity. This lets passthrough entity owners deduct a larger portion of their income taxes paid against their federal income.

Can my passthrough entity take advantage of a PTET election?

There are several factors to consider in determining whether your passthrough entity can take advantage of this election.

- First, you must review your state’s specific regulations. Some states will only allow passthrough entities with individuals to make the election. Oregon, for example only allows partnerships or S corporations with individual owners to elect to pay the tax. Other states disallow passthrough entities with partnership owners to make the election. Minnesota, for example, does not allow a passthrough entity that has an owner that is either a partnership, LLC, or corporation to elect to pay the tax.

- Passthrough entities must also take into consideration how long the election will last. Some states consider the election to be binding until the passthrough entity revokes the election. Other states require an election to be made annually. For example, in Alabama, the election is binding, and in California the election must be made annually.

- Another factor to consider is whether a state allows relief for estimated tax payments for the initial effective tax year. New York, for example had allowed passthrough entities to make an optional tax payment in 2021, the first year it allowed passthrough entity tax to be paid.

Ultimately, determining your benefit in participating in an elective PTE or PTET will require several computations.

These computations consist of various elements, such as the tax implications at the entity level and how the deduction should be allocated between owners. In addition, it is important to analyze the impact of the deduction or credit on the owner’s individual state return and how the credit would affect the taxes paid computation for the owner’s resident state; the cash implications for the owners; the treatment of state credit refunds as additional federal income; and the federal tax implications on the owners.

Article by Zaid Butt, Director

.png?width=1496&height=1486&name=download%20(1).png)

.png?width=800&height=800&name=download%20(3).png)